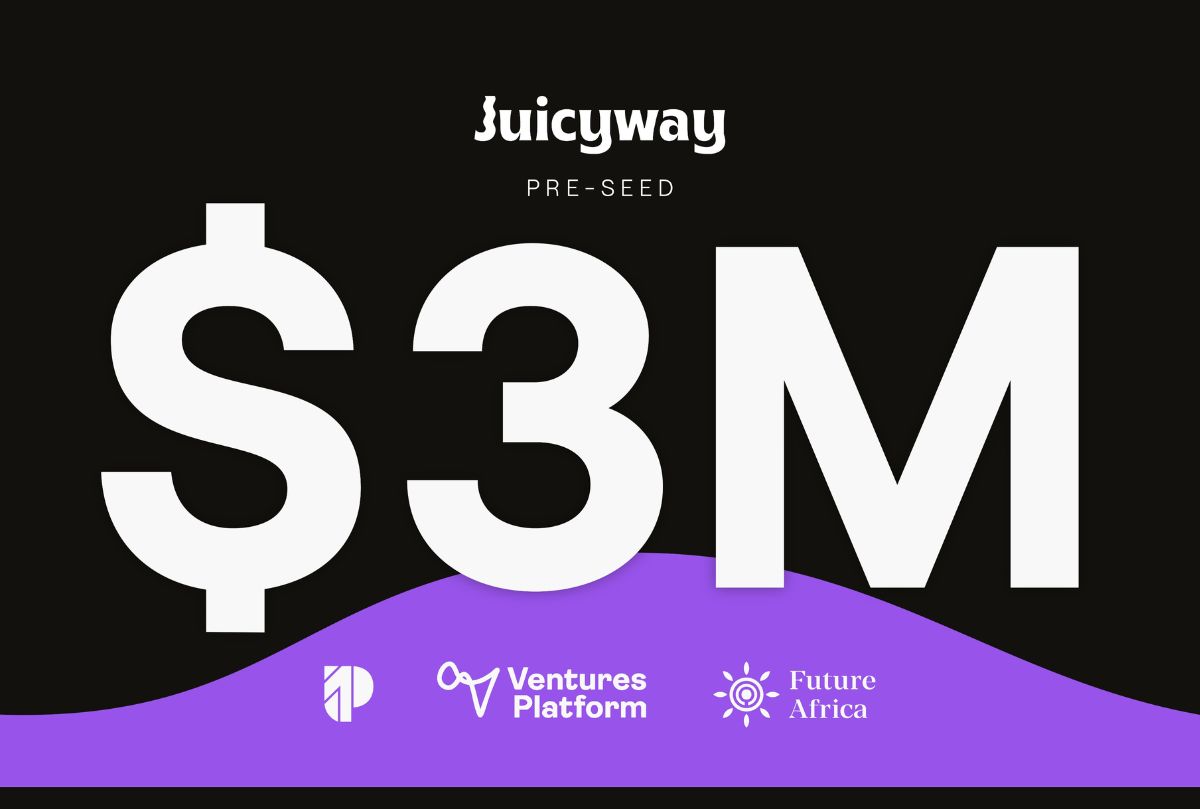

Juicyway emerges from the shadows with a significant $3 million pre-seed funding round. This payment startup, founded by visionaries Ife Johnson and Justin Ziegler in 2021, is not just another player in the fintech arena but a beacon of change aiming to redefine how Africa engages with global economies through cross-border payments.

The Vision Behind Juicyway

Juicyway’s mission is clear: to dismantle the barriers that have long plagued cross-border transactions in Africa. Leveraging stablecoin technology, the startup facilitates seamless, low-cost, and rapid transfers across borders, supporting both traditional fiat currencies like the Nigerian Naira, US Dollar, and Canadian Dollar, alongside cryptocurrencies. This dual approach not only democratizes access to global markets but also introduces a layer of stability and predictability to transactions, which is often lacking in regions with volatile currency markets.

Funding: A Catalyst for Growth

The recent funding, spearheaded by P1 Ventures with contributions from Ventures Platform, Future Africa, and Magic Fund, marks Juicyway’s official exit from stealth mode. This investment isn’t just capital; it’s a vote of confidence in Juicyway’s potential to alter the financial narrative in Africa. The funds are earmarked for critical areas:

-

Team Expansion: Bringing on board seasoned professionals like Joshua Wasserman, once with the U.S. FDIC, and skilled engineers Ridwan Otun and Ukeoma Chukundah, to navigate regulatory landscapes and enhance technological capabilities.

-

Technological Advancements: To further refine their platform, ensuring it remains at the forefront of payment solutions with features like multicurrency accounts and API integrations for broader financial inclusion.

-

Market Entry: Plans to venture into new territories, both within Africa and globally, to expand its footprint.

Addressing Africa’s Liquidity Conundrum

Ife Johnson, co-founder and CEO, highlights a stark reality: Africa’s contribution to the global currency market is minuscule, largely due to the lack of liquidity for intra-African currency pairs. Juicyway’s strategy involves using stablecoin technology to unlock these liquidity pools, thereby simplifying trade and remittances. This approach could potentially reduce the high remittance costs, which currently average 13% for a $200 transfer in Africa, making financial services more accessible and less burdensome for the average consumer.

Juicyway’s Competitive Edge

In a market crowded with fintech innovators like Chipper Cash, Flutterwave, and Afriex, Juicyway distinguishes itself with:

-

Stablecoin Integration: Offering stability and speed that traditional banking systems in Africa often can’t match.

-

Real-Time Transactions: Reducing the wait times associated with cross-border payments, which is crucial for businesses and individuals alike.

-

Transparent Pricing: Through its platform, customers benefit from market-driven rates, enhancing trust and efficiency in transactions.

The Economic Impact

With remittances forming a significant portion of Africa’s GDP (5.2% in 2023), platforms like Juicyway could revolutionize how these funds are managed. By lowering costs and increasing speed, Juicyway doesn’t just facilitate transactions; it empowers economic growth by allowing more money to stay within the communities where it’s needed most.

What Lies Ahead

As Juicyway moves forward, the challenge will be to scale while maintaining the integrity and efficiency of its platform. The startup’s journey is set against a backdrop of a continent ripe for financial innovation, where each successful transaction could mean more than just money moving across borders; it could mean lives transformed, businesses empowered, and economies invigorated.

In conclusion, Juicyway’s $3 million pre-seed funding is more than a financial milestone; it’s a beacon for what’s possible when technology, vision, and necessity converge. The road ahead for Juicyway in reshaping Africa’s financial narrative is both promising and pivotal, with the potential to not only change how payments are made but also how economic opportunities are distributed across the continent.

Visited 31 times, 1 visit(s) today

Post Views: 1,915

and then

and then