In a historic turn of events, Bitcoin has soared to an all-time high of $80,000 following Donald Trump’s decisive victory in the 2024 U.S. presidential election. This surge marks a pivotal moment not only for Bitcoin but for the entire cryptocurrency market, as investors anticipate significant regulatory changes under a Trump administration that is poised to embrace digital currencies.

The Political Landscape

With Trump securing the presidency and the Republican Party inching closer to full control of Congress, the political landscape is shifting dramatically. The GOP has already gained a majority in the Senate, setting the stage for a legislative agenda that aligns with Trump’s pro-business and pro-crypto policies. On the campaign trail, Trump promised to transform the United States into “the crypto capital of the planet,” pledging to create a strategic Bitcoin stockpile and appoint financial regulators who are friendly towards digital assets.

Expectations of Deregulation

One of the most significant implications of Trump’s victory is the anticipated deregulation of the cryptocurrency industry. Analysts believe that if Trump follows through on his promises to strip back regulations, it could lead to a substantial increase in Bitcoin’s value. Matt Simpson, a market analyst at StoneX Financial, stated, “If the Trump administration does deregulate crypto, it’s hard to see how it is not bullish for the sector.” He further suggested that Bitcoin prices could potentially reach $100,000 in this favorable environment.

Market Reaction and Trends

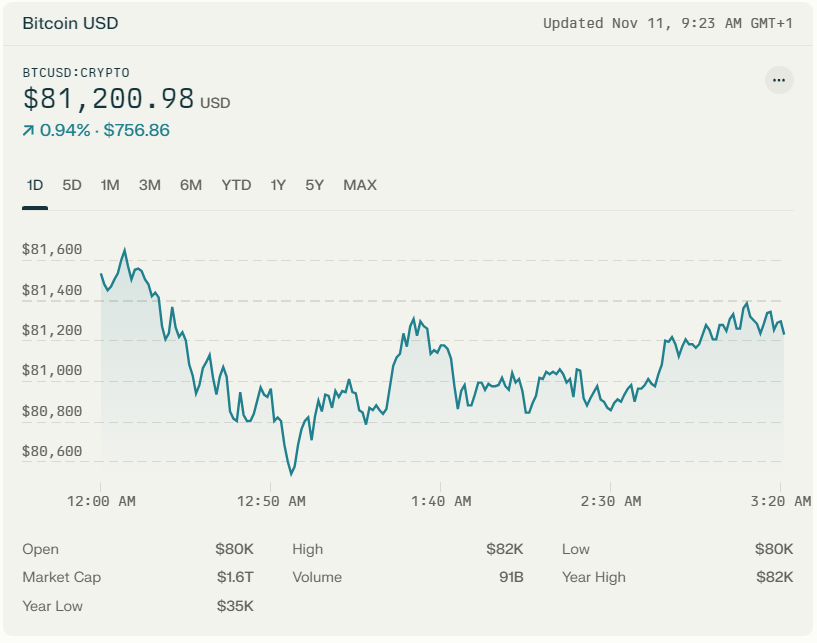

The cryptocurrency market has reacted positively to these developments. Bitcoin’s value has surged by over 80% this year alone, reflecting heightened investor enthusiasm. Other cryptocurrencies, including Dogecoin—often promoted by high-profile Trump supporter Elon Musk—have also experienced significant gains. This bullish sentiment is indicative of a broader trend where investors are increasingly viewing cryptocurrencies as viable alternatives to traditional investments.

Volatility and Risks

Despite this optimistic outlook, experts caution that Bitcoin remains vulnerable to volatility. Simpson noted that while deregulation could drive prices higher, there is also potential for sharp sell-offs that could impact smaller investors. The cryptocurrency market is known for its fluctuations, and while many are optimistic about future growth, caution is warranted.

Broader Economic Implications

Trump’s electoral victory has also had a ripple effect on other financial markets. Major stock indices have seen gains in recent days, and U.S. bonds have strengthened as investors react favorably to Trump’s broader economic agenda. His plans include cutting taxes and reducing regulations on businesses, which are expected to stimulate investment across various sectors.With Republicans potentially controlling both the executive and legislative branches of government, they will have the opportunity to advance Trump’s agenda through Congress efficiently. This alignment could lead to swift legislative changes that support both traditional and digital economies.

Conclusion

Bitcoin’s rise above $80,000 signals not just a milestone for cryptocurrency enthusiasts but also reflects significant political changes in the United States. As Trump prepares to take office with a pro-crypto agenda, investors are watching closely for regulatory shifts that could further propel Bitcoin and other cryptocurrencies into mainstream acceptance.As we enter this new era for digital assets, it remains essential for investors to stay informed about market trends and potential risks. The future of cryptocurrency may be bright under a Trump administration, but as history has shown, volatility is always just around the corner. Whether Bitcoin can maintain its momentum or reach new heights will depend on both political developments and market dynamics in the months ahead.

and then

and then