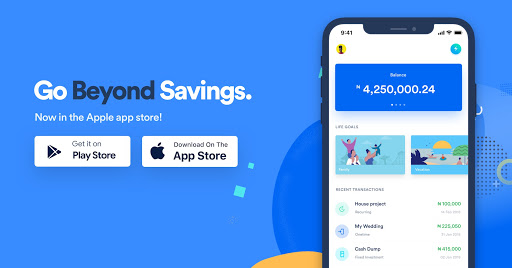

Cowrywise is an online finance company that helps people plan, manage, save and even make money online.

Many people find it had to save on a normal basis but with personal finance company like Cowrywise, savings has become easy and interesting.

However, we know it could be a huge strain trying to figure out how the Cowrywise platform works, as it takes away the stress and planning done to save and invest.

That’s why we would show you how to use Cowrywise and everything to know about the platform.

What is Cowrywise all about?

Cowrywise is a personal finance company that is all about providing legit and safe financial services to people.

Its mission is to empower people to take charge of their finances.

The company helps people to easily and consistently save and invest their money on its platform.

Over the years of its existence, the Fintech company has rapidly gained widespread usage.

It has over 100,000 downloads on the play store and has an approval rating of 4.5 stars from 1,771 persons.

Also, the company has been providing a lot of financial stability to those going through the following.

- Those who never meet up with their savings or investment goals.

- People who want to save without having to go through bank struggles.

- Those who want to keep themselves disciplined for long term savings.

- Also, people who want to use financial tools to plan their financial goals.

When was Cowrywise created?

The Nigeria based startup was founded by Edward Popoola and Rasaq Ahmed on January 1, 2017.

They founded the company to offer excellent financial services in the form of tools, advise and guides.

Also, they wanted to help in wealth management and grant a seamless journey in wealth creation.

However, the company is controlled by Meristem Trustees Limited, a Securities and Exchange Commission (SEC) registered company.

How does Cowrywise work?

Numerous fintech companies are existing in Nigeria.

However, what differentiates them is how they work and what unique services each of them is bringing to the table.

Below, we would show you how Cowrywise works and what it keeps bringing to the tables of its users.

The online platform aims at providing financial stability to users. In delivering financial freedom, it offers three steps, namely;

- Plan money

- Save money

- Invest money

1. Plan money:

A typical quote says, “A man that fails to plan, plans to fail.” Many people detest failure, so they must plan.

We can’t leave our finances out of the process of planning. People need to plan for unforeseen circumstances, fees, retirement, starting a family and many others.

Planning for the future could be a tedious process.

However, Cowrywise has made the process easier as it allows you to plan for things of your interest.

Also, it provides an easy to use tool that enables you to prepare for future moments.

Some of the tools include:

- A tool that gives comprehensive research to plan for your child’s education.

- An interesting tool that allows you to calculate the estimate of your savings and returns.

Also, Cowrywise provides free guides on planning.

You should know that Planning works along with saving and investing.

2. Save money

A penny saved is a penny earned, goes a popular saying.

The subject of saving is not new to everyone as it’s necessary for planning for future purposes.

We all deserve good things in life. But what happens when you can’t meet your future needs.

Well, this is where savings come in.

Cowrywise provides an automated system that allows you to save and grow your money.

Saving is much work than just stashing your money somewhere.

Stowing your money in a wooden box like Kolo (Yoruba’s wooden saving box) does not increase it.

So, what you saved is what you get. the same amount of money you saved is what you have.

But with Cowrywise, it is different. You get to save and earn returns without any penalties or fees.

Also, you can keep your money as long as you can without any limitations. You can also save multiple times with one account.

Here are types of saving plans to adopt and make more money:

Types of saving plans on Cowrywise:

Regular savings: this is just the typical day-to-day savings. You are saving the money in your terms for a minimum of three months. You can decide to save daily, weekly or monthly and in which, after, you get a reward.

Life Goal savings: this is a long term savings account for essential life matters. It entails a minimum of a year with an excellent return.

Halal savings: this form of savings is for the Muslim entity. It allows them to save without riba (Muslim term for interest-free loans). They could save as a regular saving, life goal, periodically, but it doesn’t attract interest.

Saving circle: It allows you to set targets and to save together with others. You can save money along a circle of people with related interests such as experience, donations, collection or as a challenge.

Getting Started:

For you to get started with a savings plan, below are steps to take.

- If you are new, download and install the app.

- Then create an account and sign in to your Cowrywise account.

- After signing in, it asks that you create a Cowrywise password.

- Then it requests for your BVN and date of birth.

- Go to “New savings plan.”

- Pick any plan of your choice.

- Enter your plan’s name.

- Choose between automatic debiting or save “When I want to.” This is to debit you immediately or you depositing at your convenience, respectively.

- Then, toggle between daily, weekly or monthly.

- Type the amount to save.

- Choose when you prefer to start.

- Click on the duration of the savings.

- It takes you to a review page to check your choices, and then click on “Let’s do this.”

- Click on a payment plan.

- Note that in verifying your card, Cowrywise will debit 100 naira from your account.

- Then, impute your card’s details.

- And finally, click on activate your plan.

How to suspend your savings plan

Note that you can pause your savings plan. If you are interested in suspending your savings plan, below are steps to follow.

- Click on the plan you wish to pause.

- Tap “Edit.”

- Click on the plan status to pick between “Active” and “Pause.”

- Select “Pause”

- After tap “Save” to save changes made

3. Invest money

Cowrywise helps to make the process of investment simpler.

Investing with Cowrywise means you invest in mutual funds. That is, pooling money from small investors to make a massive investment. Such kinds of investments include: balanced funds, equity funds, etc.

How do I invest in mutual funds?

You should know the platform has four types of mutual funds.

- Money market funds.

- Bond funds.

- Equity funds.

- Balanced funds.

However, breaking the fund further, we have Halal and the Dollar funds. To use any of the funds above, follow the steps below.

- You can invest using Cowrywise. You require to sign in/log in to your account.

- Choose a fund

- Then buy all the units of the fund to invest your money.

- Be patient and watch your cash evolve with returns.

Before involving in mutual funds, check for the prevailing rate and how much you stand to earn. It would help you to know the status of the return you make on a plan.

Also, Cowrywise provides professionally-managed investment products which include the below.

Invest as you go: just like they provided automated savings, there is an automated way to invest. With its System Investment Plan (SIP), it allows you to invest your money periodically.

ALSO READ: BUSINESS/STARTUPS#EndSARS: Paystack, Cowrywise Contribute Funds To Support Protests

Everyone is welcome: This empowers anyone to use it, regardless of your financial status. That is, you don’t have to be a millionaire to invest; you can start from as little as you have.

Advisory to help: a person can feel confused about steps to take. Well, Cowrywise offers free advisory sessions to help navigate your investment road.

Before you can start planning, saving, and investing, you need to create an account.

How to create a Cowrywise account:

- Download the app and install

- Or go to the website.

- Fill in your details, ranging from your names, number, email address and provide a password.

- Then click on continue.

- It creates an automatic username for you. But you can change it to your preferred name after you click “Continue.”

- It then asks you to crosscheck your email and after, then click on “Yes, create my account.”

- It sends a confirmation message to your email and a verification link.

- Go to your mail and click on “Activate Email.”

- It goes back to the “Login” page for you to log in.

- That’s it!

To delete a Cowrywise account, follow the steps below.

- Sign in to your registered email address and compose a message.

- Title the mail “A request for Cowrywise Deletion.”

- Compose the mail stating you want to close your account.

- When done, send a mail to “support@cowrywise.com.” by inputting the address and your account would be deleted.

What is the Cowrywise interest rate?

Cowrywise interest rate is the amount of money a person tends to gain from a plan from a period of time.

The interest rate on each plan varies according to the investment. Asides, the rate goes through a periodic change (annually).

However, the rate is dependent on treasury bills and government bonds.

Note that at the point of creating a plan, the interest rate is shown to you.

However, if the rate increases, there would be an automatic update for a new plan or rolls over to a new plan.

So, the interest rate on your savings plan is determined by the rate shown to you at that point of creating a plan. Also, the rate will determine the amount you have at the maturity date.

Also, You should know that the higher the timeline for the investment, the higher the returns.

Is Cowrywise safe?

To answer questions like, is Cowrywise legit or if it is safe to use, we would say reviews from many users say it is safe.

The fintech company is built with a system of data security. They offer excellent customer service by securing the details of every account in an encrypted form.

Also, it works with a PCI DSS, a standard guide that all reputable payment processors adhere to.

In addition to that, Cowrywise partnered Meristem Trustee to establish a trust structure.

Also, the company is registered with the Securities and Exchange Commission (SEC) and most companies with these qualifications are usually trusted.

The SEC and the Trustee ensure the security for users’ funds and monitor how the money is invested by the company.

They also hold a certificate that verifies the savings of a person.

Conclusion:

Now that you know all about Cowrywise, you can choose to explore the platform for your savings and investments purpose.

However, if you are still seeking to know more about the platform, Cowrywise has excellent customer service for your needs.

and then

and then

I bought a unit of 1000 thousand Naira but the thing is that my balance doesn’t increase on a daily basis.