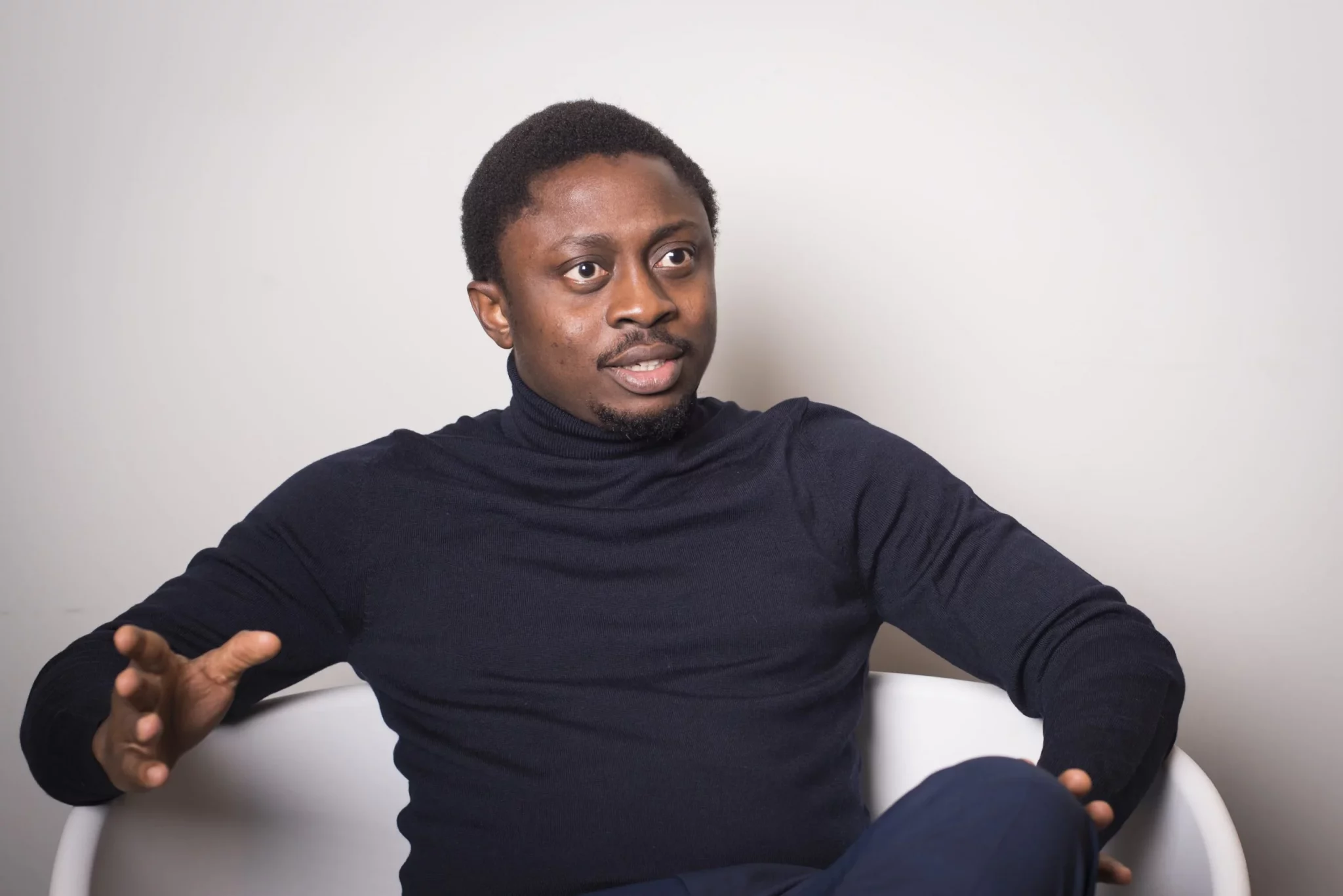

the journey of Leatherback and its CEO, Ibrahim Ibitade, stands out not just for its innovation and growth, but for the resilience it demonstrated amidst controversy. The recent saga involving the Economic and Financial Crimes Commission (EFCC) underscores the precarious balance between regulatory oversight and fostering innovation in the financial sector.

Three months ago, the EFCC’s spotlight turned unexpectedly on Ibitade, thrusting him into a narrative fraught with allegations and public scrutiny. The agency’s action to declare him wanted for allegedly conspiring to obtain money under false pretenses, without what Ibitade describes as “due diligence,” spotlights the potential hazards fintech companies navigate in emerging markets. This incident, which culminated in Leatherback’s legal action against the EFCC for defamation, reveals much about the challenges and dynamics at play in Nigeria’s bustling financial technology landscape.

Leatherback’s story is not just one of a legal skirmish; it is a testament to the company’s commitment to its mission and the trust it has built over five years. Operating across seven countries, Leatherback has carved a niche for itself in the competitive realm of cross-border payments, demonstrating the potential for technology-driven financial services to transcend borders and regulatory landscapes.

The crux of the controversy hinged on the activities of SDQ Financials, a company implicated in questionable foreign exchange deals that resulted in significant financial losses. The use of Leatherback’s wallets by SDQ Financials, unbeknownst to Leatherback regarding the alleged fraudulent activities, highlights the complex web of transactions fintech companies manage and the imperative for robust due diligence and compliance frameworks.

Despite the turbulence, Leatherback’s resilience is noteworthy. The company’s ability to maintain its operations and continue its growth trajectory amidst the EFCC saga underscores a critical lesson for the fintech sector: the importance of building a business that can withstand the challenges inherent in operating within highly regulated and often unpredictable markets.

Looking to the future, Ibitade’s bullish stance on the Nigerian market is a reflection of the broader optimism that characterizes the fintech industry in the region. With Nigeria’s bustling payments space as a backdrop, Leatherback’s journey from handling $500 million in monthly transactions to nearing the $1 billion mark before the EFCC episode is a narrative of ambition, challenge, and resilience.

This episode with the EFCC, while challenging, catalyzes dialogue on the balance between regulation and innovation. It underscores the need for regulatory bodies to engage with emerging financial technologies in a manner that safeguards the public interest while fostering the growth and dynamism of the fintech ecosystem.

As Leatherback continues to navigate the complexities of the global financial landscape, its story offers valuable insights into the resilience required to thrive in the fintech sector. The company’s experience highlights the importance of transparency, robust internal controls, and the need for a regulatory environment that supports innovation while ensuring financial stability and integrity. In this dynamic interplay between regulation and innovation, Leatherback’s journey is a compelling study of the challenges and opportunities that define the evolving world of fintech.

Found this interesting? Share!

and then

and then