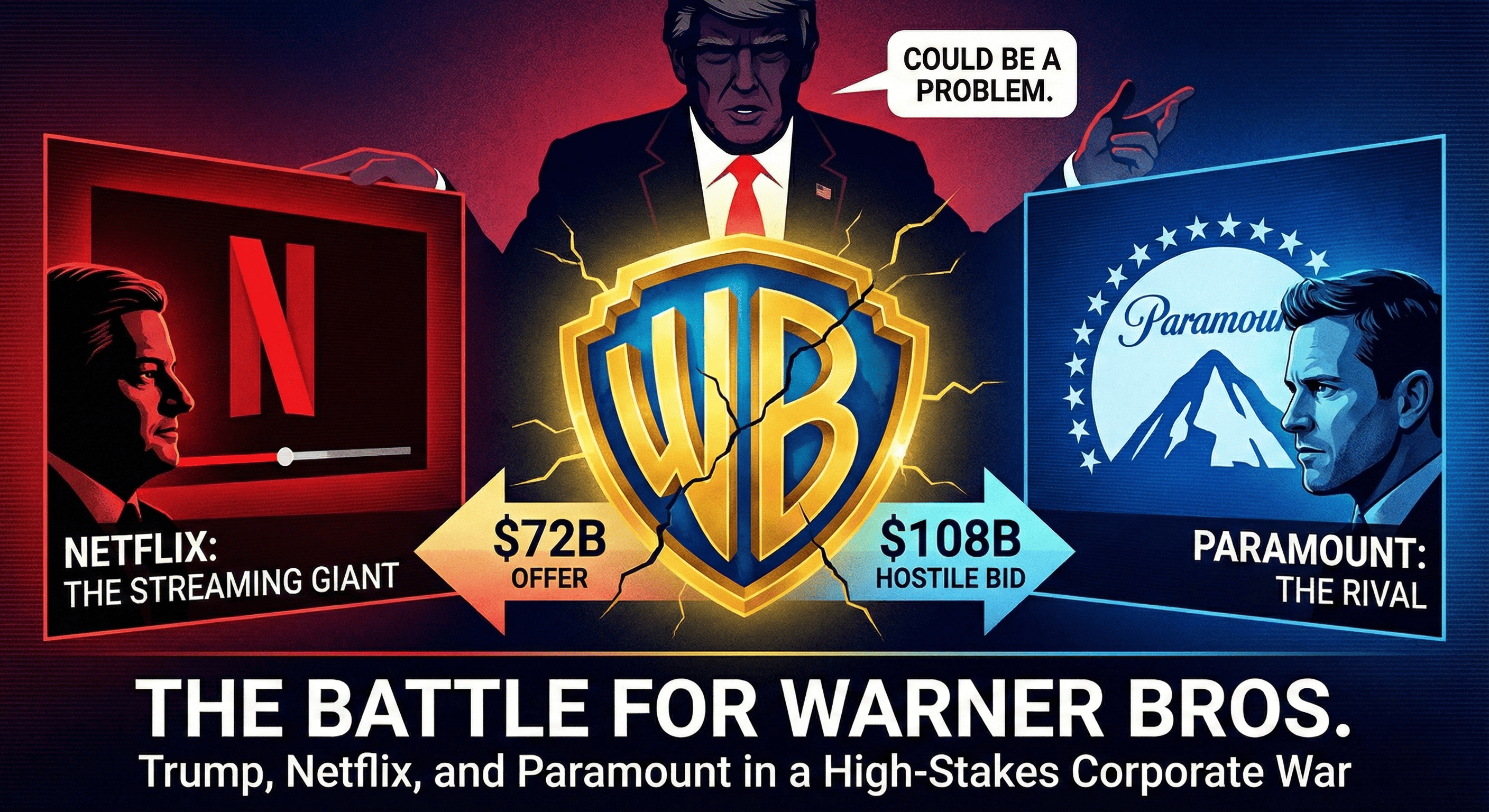

The streaming giant’s biggest acquisition faces presidential scrutiny and a determined rival with deep pockets and political connections.

What started as Netflix’s boldest move yet has turned into one of Hollywood’s messiest corporate battles, with President Trump throwing regulatory shade and Paramount refusing to walk away quietly.

On December 5, Netflix shocked the entertainment world by announcing it would acquire Warner Bros. Discovery’s film studio, TV production, HBO, and HBO Max for $72 billion in equity (or $82.7 billion including debt). The deal would give Netflix control of massive IP including Batman, Harry Potter, Game of Thrones, and a century’s worth of Warner Bros. films.

However, just two days later, President Trump stated the deal “could be a problem” due to market share concerns. escalating the situation, Paramount launched a hostile takeover bid on December 8, offering shareholders $30 per share in all cash for the entire company, valued at $108.4 billion.

Now, Warner Bros. Discovery finds itself caught between two tech-powered suitors while regulators and politicians circle with antitrust concerns.

How We Got Here: The Warner Bros. Crisis

Warner Bros. Discovery has struggled since its 2022 formation when AT&T spun off WarnerMedia to merge with Discovery. The company carried massive debt, streaming growth stalled, and its stock price cratered to a low of $7.50 at one point this year.

In September, Paramount CEO David Ellison made an unsolicited $19-per-share bid. Warner Bros. Discovery CEO David Zaslav rejected it, but the move forced his hand. He announced plans to split the company in two:

-

Assets: Valuable studios and streaming services.

-

Liabilities: Declining cable networks like CNN, TNT, and TBS.

That spinoff plan, scheduled for mid-2026, triggered a bidding war. After three rounds of aggressive bids between Paramount, Comcast, and Netflix, the board initially chose Netflix on December 5.

Breakdown: The Netflix Deal Structure

Netflix’s offer is a strategic pivot for a company that famously avoided major acquisitions.

-

Offer Price: $27.75 per Warner Bros. Discovery share.

-

Composition: $23.25 in cash + $4.50 in Netflix stock.

-

Total Value: $72 billion equity ($82.7 billion enterprise value).

-

Scope: Covers only studios and streaming (excludes cable networks).

-

Timeline: 12–18 months, subject to regulatory approval.

What Netflix Gains:

-

Warner Bros. film and television studios.

-

HBO and HBO Max streaming platforms.

-

The DC Universe (Batman, Superman, Wonder Woman).

-

Iconic franchises: Harry Potter, Game of Thrones, The Sopranos, Friends.

The Breakup Fees: The stakes are incredibly high. If the deal fails regulatory approval, Netflix owes Warner Bros. Discovery $5.8 billion. If Warner Bros. backs out to pursue Paramount, it owes Netflix $2.8 billion.

Trump Throws Cold Water on the Deal

On December 7, President Trump made his position clear regarding the Netflix acquisition while attending the Kennedy Center Honors:

“Well, that’s got to go through a process… Netflix is a great company… but it’s a lot of market share. So, we’ll have to see what happens. I’ll be involved in that decision, too.”

While Presidents typically avoid commenting on specific open merger reviews, Trump has made corporate deal-making central to his economic agenda. Following his comments, prediction markets on Polymarket showed the odds of the deal closing by 2026 dropping from 60% to 23%.

This echoes July 2025, when Trump approved the Paramount-Skydance merger only after specific concessions were made regarding DEI programs and CBS News oversight.

The Antitrust Problem

Regulatory concerns focus on market dominance. Netflix already leads with over 300 million subscribers. Adding HBO Max’s 128 million subscribers would result in a combined entity controlling roughly 30% of the global streaming market (and potentially 43% in the U.S.).

-

Senator Elizabeth Warren called the deal “an anti-monopoly nightmare.”

-

Senator Mike Lee (Chair, Senate Judiciary Subcommittee on Antitrust) promised “an intense antitrust hearing.”

-

Netflix’s Defense: They plan to argue the market definition should include YouTube, social video (TikTok/Instagram), and gaming, not just subscription streaming.

Paramount’s Hostile Counter-Bid: The “Nuclear Option”

Refusing to concede, Paramount bypassed the Warner Bros. board on December 8 to appeal directly to shareholders.

Paramount’s Offer:

-

Price: $30 per share (All Cash).

-

Total Value: $108.4 billion enterprise value.

-

Scope: Includes the entire company (studios + cable networks).

-

Cash Advantage: Offers $17.6 billion more cash than Netflix.

The Financial Backing: Paramount’s war chest is funded by the Ellison family (Larry Ellison), RedBird Capital, Saudi Arabia’s PIF, and Affinity Partners—founded by Jared Kushner, Trump’s son-in-law.

Kushner’s involvement has raised significant questions about whether political connections could tip the regulatory scales in Paramount’s favor.

The Theater War: Streaming vs. Cinema

The two deals represent opposing futures for Hollywood.

-

Netflix Model: Historically prioritizes streaming. While Ted Sarandos pledged to honor current theatrical commitments, he hinted that windows will “evolve” (shrink).

-

Paramount Model: Promised to release 30+ films theatrically per year with traditional windows.

Cinema United, representing theater owners, called the Netflix deal “an unprecedented threat,” while praising Paramount’s commitment to the big screen.

The African Context: What This Means for Viewers

For African audiences and creators, this mega-deal carries specific implications.

-

Content Access: If Netflix acquires the Warner Bros. library, it could mean expanded access to premium content like HBO’s back catalog within the standard Netflix subscription.

-

Investment: Netflix has been aggressively investing in African originals. Gaining access to Warner Bros.’ global infrastructure could accelerate production capabilities on the continent.

-

Pricing Risks: Consolidation usually limits competition. African subscribers, already managing currency fluctuations, could face steeper subscription costs if a single entity gains massive pricing power.

What Happens Next?

Warner Bros. Discovery’s board has 10 business days to review Paramount’s hostile offer.

Both Sarandos and Ellison project confidence, but the outcome will likely depend less on economics and more on political calculations in Washington. With Trump signaling he intends to be “involved,” this battle could drag well into 2026.

What do you think? Should regulators block the Netflix deal to preserve competition, or allow it so they can compete against Amazon and Apple? Drop your thoughts in the comments.

and then

and then