Recently launched Nigerian fintech startup, Blueloop has been accepted into the Y-Combinator acceleration program.

The barely seven-month-old startup will be joining the winter 2021batch of the US-based accelerator alongside ten other African startups.

Upon completion, the startup will have access to $125k in seed funding made available by the accelerator to boost its global expansion plan.

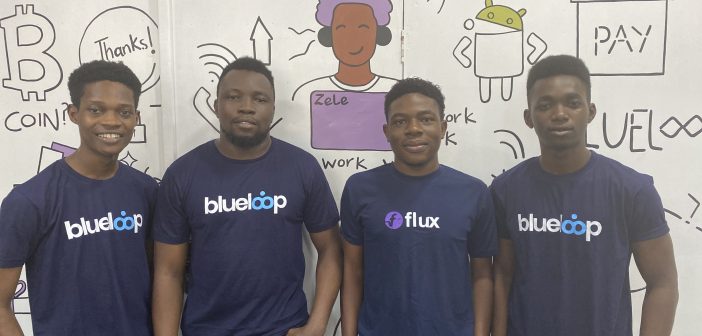

Meet Blueloop and the young talents behind the innovation

Firstly, it is interesting to discover that the Nigerian fintech space has produced yet another innovative startup we can hope, in few years, can become a unicorn just like its senior colleague – Flutterwave.

So what is Blueloop all about? Let’s dive into full details.

Founded in September 2020 by Ben Eluan, Osezele Orukpe, and Israel Akintunde, Blueloop is the brain behind Flux – a cross-border mobile payment platform that leverages cryptocurrency.

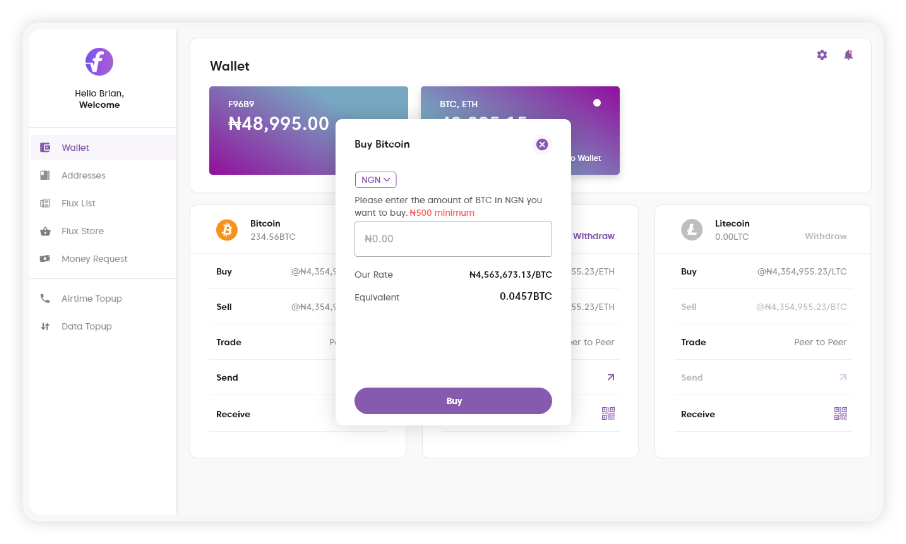

With the flux platform, users, either as individuals or businesses, can send and receive money from anywhere around the globe in cryptocurrency and subsequently convert to fiat currency.

The app, which also works like a regular bank app, allows users to send and receive money locally, send money to banks, and pay for goods and services.

The app, which also works like a regular bank app, allows users to send and receive money locally, send money to banks, and pay for goods and services.

Although launched in September, the idea was birthed in April 2019, while the founding team began work fully on Flux in February 2020 with the release of a prototype two months after.

ALSO READ: Flutterwave Partners PayPal To Enable African Merchants Send, Receive Funds

Following its launch in September, the startup welcomed its first pre-seed funding of $77K backed by Hustle Fund VC, Pioneer, Mozilla, and a few other angel investors.

Blueloop was inspired by a school project – Joppa

An interesting part of this discovery is that two of the founding team members – Ben Eluan, and Osezele Orukpe, the CEO and Co-founders, were students of Obafemi Awolowo University.

In his comment, Eluan buttressed how the student community influenced and boosted their performance at the early stage of launch.

According to Eluan, project Flux is an adaptation of an initial concept – Joppa – that the team worked on as a school project.

The idea behind Joppa was to help students find and buy products from merchants within the University, something that blew up and attracted about 20,000 students to the site.

Building on the little success, the funding team was inspired to build Flux and having researched cryptocurrencies and KYC, the team spotted a gap in the payments space.

“There were a lot of apps that let you receive cash from some major countries using fiat, but there was still so much work to be done in terms of how fast users can get their cash available for spending and how cheap they could do this,” Eluan told Disrupt Africa

Spotting the above need and having confidence in the ability to profer a solution, Flux set out to own its own share of the finance market while competing with the likes of Bundle Africa, who offer similar solutions in the highly saturated market.

“Our advantage is that we have built our app to have more functionalities. For example, it can be used by merchants to accept payments, gig people to receive payments, and regular users to send and receive money.

“Here in Nigeria, we can pay for Bolt using bank transfer, and our users use our app to do this also, pay for stuff in malls, send money to other banks, and all this combined with great user experience,” Eluan added.

The journey to become a global super app isn’t void of challenges

As you would expect of typical student life, mixing education with something as technical as building a payment platform is no joke.

Apart from the basic constraint of work and class schedule, other challenges also played out amongst the founding team.

ALSO READ: Kuda’s Latest $25 Million Seed-Funding Signals Warning To Traditional Banks

According to Eluan, building Joppa was one thing, but building a more complex fintech solution like Flux required more skills and resources beyond finance.

“Initially, we were just developers who loved to code. I remember building an eCommerce app called Joppa, which went viral on campus but we had no idea about how to build a startup or business around it,” Eluan recounted.

The team had to solve its then biggest challenge of finding a crypto exchange that would offer liquidity and an API they could leverage.

At that time, the only help they could get was from Nigerian crypto exchange, Quidax, who subsequently tapped into the vision and further kick-started the project.

Although it got the required help, Eluan buttressed how the Nigerian ecosystem does little to support upstarts. For them, it was one of the main reasons they had a tough beginning.

“Getting accepted into the YC accelerator program validates our work at Blueloop”

Beyond the seed-funding of $125K, YC’s acceptance of Blueloop suggests many things, among which is reputation.

Firstly, by getting accepted into the YC accelerator program, Blueloop joins other reputable companies like PayStack, Flutterwave, Kobo360, and Buycoins, among others that have gone through the accelerator.

The reputation that comes with being accepted into the accelerator program is enough to attract investment and trust from users within Nigeria and beyond.

In his comment, Eluan said that getting into YC was a good validation of the work being done at Blueloop and, undoubtedly, a testament to the impressive growth it has recorded so far.

On what the startup intends to make do of the new development, Eluan said the team would maximize every opportunity accessible at the YC program.

“We plan to leverage the funds, the mentorship, and the awesome global network of startups and investors, to build our product into a global product,” Eluan said.

Flux will further build on its little wins

In the last quarter of 2020, ending November, Flux claimed to have processed over $460Kin transaction volume across its fiat platform.

Source: Flux website

Currently, the platform records over $700K in monthly transactions and makes 1% of its transaction volume, suggesting a profit revenue of $7K per month as at the time of this publication.

ALSO READ: Nigerian Company Enmeshed In Data Breach, Fined N5m

Eluan also attributed the platform’s upsoaring transaction volume to the increasing activity in the crypto and fiat section.

In his explanation, “Two types of people use our app. Those who want to use crypto, and those who want a different kind of banking platform.”

Surprisingly, Eluan claimed to have witnessed people or businesses use the platform in unexpected ways.

“We see merchants using our platforms to accept payment. We currently have real estate startups, restaurants that use our app to accept payments from their customers.”

Spotting the unique approach to the platform’s use, Eluan and his team, therefore, built a dedicated API tool – Flux merchant.

This sub-web platform allows merchants to fully set up their accounts, fill their compliance, and generate payment links for their products and services.

For this, Blueloop charges merchants ₦100 (26 cents) on every successful transaction, subsequently opening another stream of revenue-generation.

“We also decided against building a P2P platform.”

Following the recent disruption of the Cryptocurrency ecosystem in Nigeria by the Central Bank of Nigeria, Crypto-based platforms seek refuge in P2P remittance.

On the contrary, despite being affected by the apex bank’s policy that bans local banks’ use for crypto trading, the Flux team decided against building a P2P platform.

“Two weeks before the crypto ban, we had already shifted our focus to our flux merchant. Though the crypto ban was hurtful, the new product provided a sort of safe-landing. We also decided against building a P2P platform.”

Eluan claimed Flux was never meant to be a crypto exchange platform but rather one that eases cross-border payments for Africans, leveraging on cryptocurrency.

ALSO READ: Top 5 Financial Moments Of 2020 That Shook The Nigerian Startup Space

The above challenges ignited by the Apex bank has, however, prompted the Flux team to come up with more innovative solutions.

“As part of our counter plans, we’re doubling down on moving to other regions fast. Our platform has to be available globally as that’s the kind of product we are building. We are also partnering a global company to speed up cross border payments,” Eluan said in conclusion.

Overall, seeing another rising star like Blueloop make the YC accelerator program suggests that there is a big hope for the Nigerian fintech ecosystem which has continued to witness an influx of international investment in recent times.

Most importantly, it is about time the Nigerian government looked closely into the sector that holds so much potentials, and finds ways to explore new opportunities.

and then

and then