In an ongoing development, the Nigerian government has reportedly declared three of its running power plants for sale.

These power plants, consisting of the Geregu, Omotosho, and Calabar Power Plants, will be sold for ₦434 Billion.

The shocking news was disclosed in a document shared by the Bureau of Public Enterprises (BPE) during its 2021 budget defence at Abuja.

While the power plants’ sales are slated for 2021, the FG also disclosed intentions to concession some other assets.

Some prominent ones among them include the Lagos State National Stadium and National Arts Theatre, among others.

Breakdown of the power plant sales

The three power plants, according to BPE’s report, will be sold as a separate entity.

As such, the Omotosho power plant, which is the most valuable among the three, will sell at ₦151.4 billion.

Both the Calabar power plant and the Geregu power plant will sell at ₦143.4 billion and ₦140.7 billion, respectively.

According to the report, proceeds from the sales of the three power plants will be paid into the Niger Delta Power Holding Company (NDPHC) account.

Interestingly, some of these assets, especially the Geregu power plant, are operated majorly by private investors.

ALSO READ: FG To Replace Paper-Based Assessment For Civil Servants With Digital Alternative

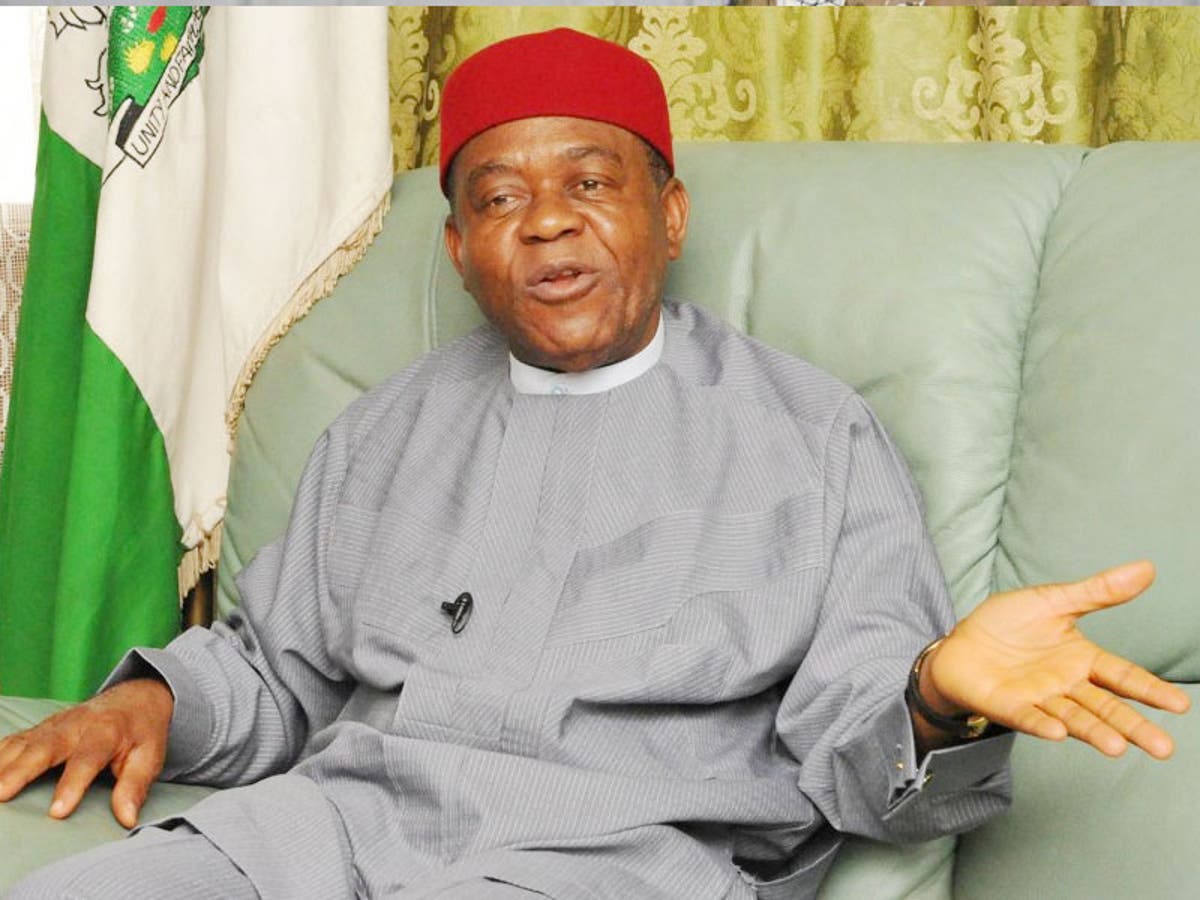

Sharing more insight on the Geregu asset, Senator Theodore Orji, member of the Senate Committee on Privatization, commented thus;

“We also found that in the Geregu Power Plant, the core investors already owned 51% shares.

“Also, the transaction emanated from a request by the investor for additional 29% of FGN residual 49%.”

Senator Theodore Orji, member of the Senate Committee on Privatization

It may also interest you to know that Nigerian billionaire, Femi Otedola, recently showed interest in the Geregu PP.

Sometimes in 2019, the business mogul disclosed intentions to diversify into power generation.

During the same period, Otedola hinted at a planned investment of up to $1 billion into Geregu Power Plc.

Also, in a recent development, Geregu Power Plc. boss, Akin Akinfemiwa revealed plans to carry out a major overhaul on the plant.

According to Akinfemiwa, the company is ready to invest about $100 million to ensure the three turbines are operational.

Not just that, beyond overhauling, the company planned to enhance the plant’s nameplate capacity from 414MW to 435MW.

Full list of Nigeria assets up for concession

- National Art Theatre, Lagos: ₦200 million

- National Stadium, Lagos: Undisclosed

- Tafawa Balewa Square: ₦436 million

- River Basin Development Authorities: ₦200 million

- Moshood Abiola Stadium, Abuja: Undisclosed

- Jos International Stadium: Undisclosed

- Adokiye Amiesimaka Stadium: Undisclosed

What the sales of this asset would mean for Nigeria

Contrary to popular opinion, privatization of government assets in developing countries isn’t a bad venture.

Often time, if handed in capable hands, privatization improves the efficiency and productivity of public enterprises.

More so, it creates room for more employment, promotes trade openness, amongst others.

Apart from improved efficiency, other benefits of privatization include a lack of political interference.

ALSO READ: Impact Of Nigeria’s 45.43% Broadband Penetration On Economic Growth

Often times, the government is seen as a poor manager of public wealth, which is unarguably true in most cases.

The Government is often motivated by the tide of politics rather than sound economic and business sense.

Also, private organizations are better at managing human resources than the Government.

As you can tell from the current civil service state, there are many glaring lapses in government-run enterprises.

On the contrary, privatization will ensure professionalism among employees while as they go for the best hands, thereby shunning nepotism, a hallmark of government.

Implications of privatizing Nigeria power plants

Regardless of the numerous benefits, there are other downsides to the privatization of the three power plants.

First is the lack of government interference. However, this wouldn’t be a concern if the market is well regulated.

In a scenario where the market is poorly regulated, this may turn out to be more disastrous for consumers.

Things such as price inflation and irregularities in quality control may pose major threats.

Take for instance, the privatization of NEPA (renamed as Power Holding Company of Nigeria- PHCN).

Things were initially going smoothly until the incessant increase in the cost of power usage set in.

Giving that more Nigerian-owned plants are on the verge of privatization, what guarantees that things will get better?

Source: Nigeria Electricity Hub

Also, privatization tends to prioritize profitability over efficiency. Unlike in the hands of the government, the consumers are rated behind profitability.

ALSO READ: #DigitalNigeria: Artificial Intelligence Is The Refinery Of A Digital Economy – Pantami

Lastly, the problem of fragmentation in the energy industry may set in. Although it is not clear if the three plants are solely acquired.

Where the plants are acquired by different investors, things like conflicting market rates may set in.

However, even when the market is regulated to prevent such activity, the quality of output may also differ.

This could, however, play to the advantage of the consumers.

What Techuncode thinks

Privatization in Nigeria remains a common practice of the federal government, however, it doesn’t necessarily solve her problems.

While the aim is to attract investment that will catalyze the nation’s economic growth, the sales of the three power plants may be driven by the wrong reasons.

Anyways, we can only hope for a smooth transition between the government and private investors.

What do you think about the sales of the three power plants?

Kindly share your thought with us in the comment section below.

Found this interesting? Share!

and then

and then