MAX has now gained recognition for becoming the first of Africa’s mobility companies to issue a bond.

If you’re unaware, MAX stands for Metro Africa Xpress.

Within a year, the company has effectively raised N400 million.

This was achieved through a rate series one that was fixed within a year.

The N400 million bond was provided alongside the company’s N10 billion or $22 million company programme.

Despite the current economic difficulties, the company found a way to make things work.

The bond was possible through the giving out of a private placement.

The placement created room for the company to get a high interest.

Additionally, the interest came from both local and international investors.

These investors also desired the kind of quality MAX is willing to offer.

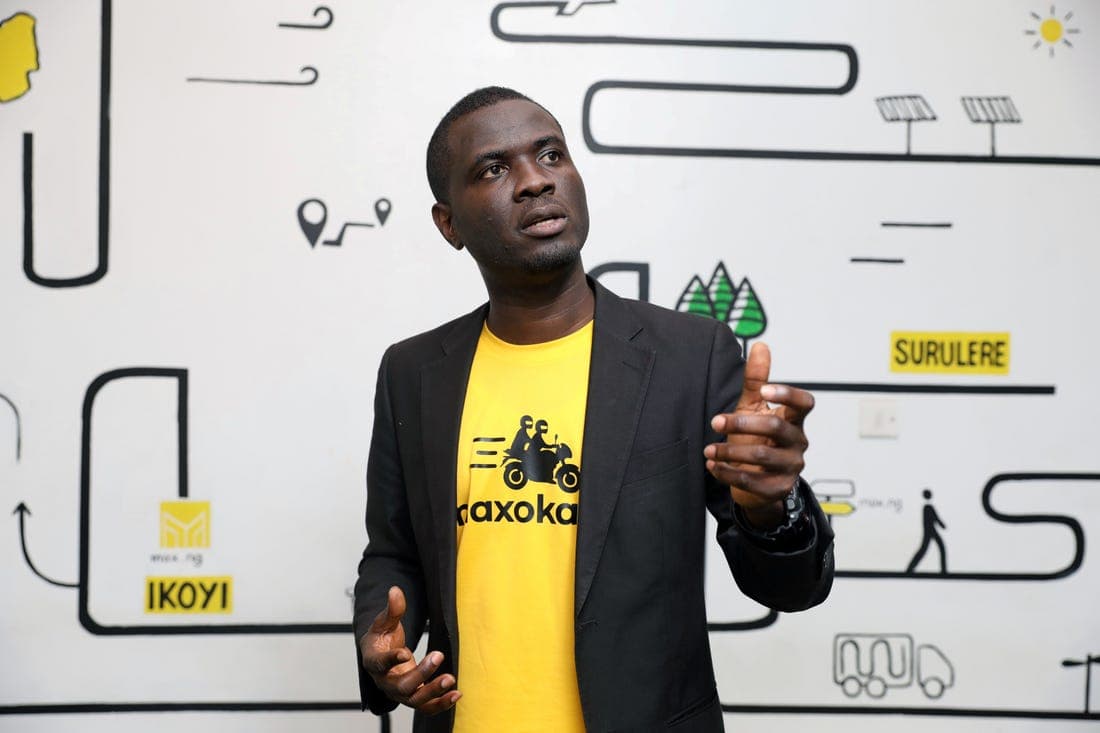

Adetayo Bamiduro, MAX’s CEO, said that the company is in line with developing technology and financing companies in Africa.

Adetayo Bamiduro; CEO, Max.ng

The money gained from the bond will be used to finance MAX’s projects.

The projects include their increasing assets like the two and three wheeler projects.

Not just that, but also other vehicles in Nigeria, included.

Adetayo, in his statement, added that DLM Advisory put the programme together.

DLM is a Nigerian bank for investments.

It also delivers other services like advisory and distribution capabilities, amongst others.

Chinedu Azodoh, the CGO and co-founder of Max.ng, also had something to say about this.

In his statement, he mentioned that the driver and vehicle collection behaviour of Max.ng is necessary.

Why? It exposed the company to the ability to manage any situation that may surface.

Situations such as the increased rate of financed drivers in up to six cities.

ALSO READ: Plentywaka Celebrates One Year Of Operating In Nigeria

Positive growth for Max.ng

Max.ng Driver

DLM has a personality of achieving success when it comes to innovative solutions.

Max.ng, to a large extent, has helped curb the issue of unemployment in Nigeria.

This bond will also do more by creating an additional 1400 employment opportunities for Nigerians.

This development will display positively on the Nigerian economy.

The Chief financial officer of Max.ng displayed sincere excitement.

Along with his excitement, he did say it’s unbelievable that they’re able to achieve their goal.

Why do you think he felt as such?

Despite the country’s current social and economic risky nature.

The head of the DLM Advisory mentioned that the bond was necessary to stay in line with the brand identity of the DLM.

The bond in question will also help the ambitious concept of MAX.

There is also the plan of hope that this bond initiative will make room for other projects and partnerships.

and then

and then