-11Days

-13Hours

-51Minutes

-58Seconds

Introduction

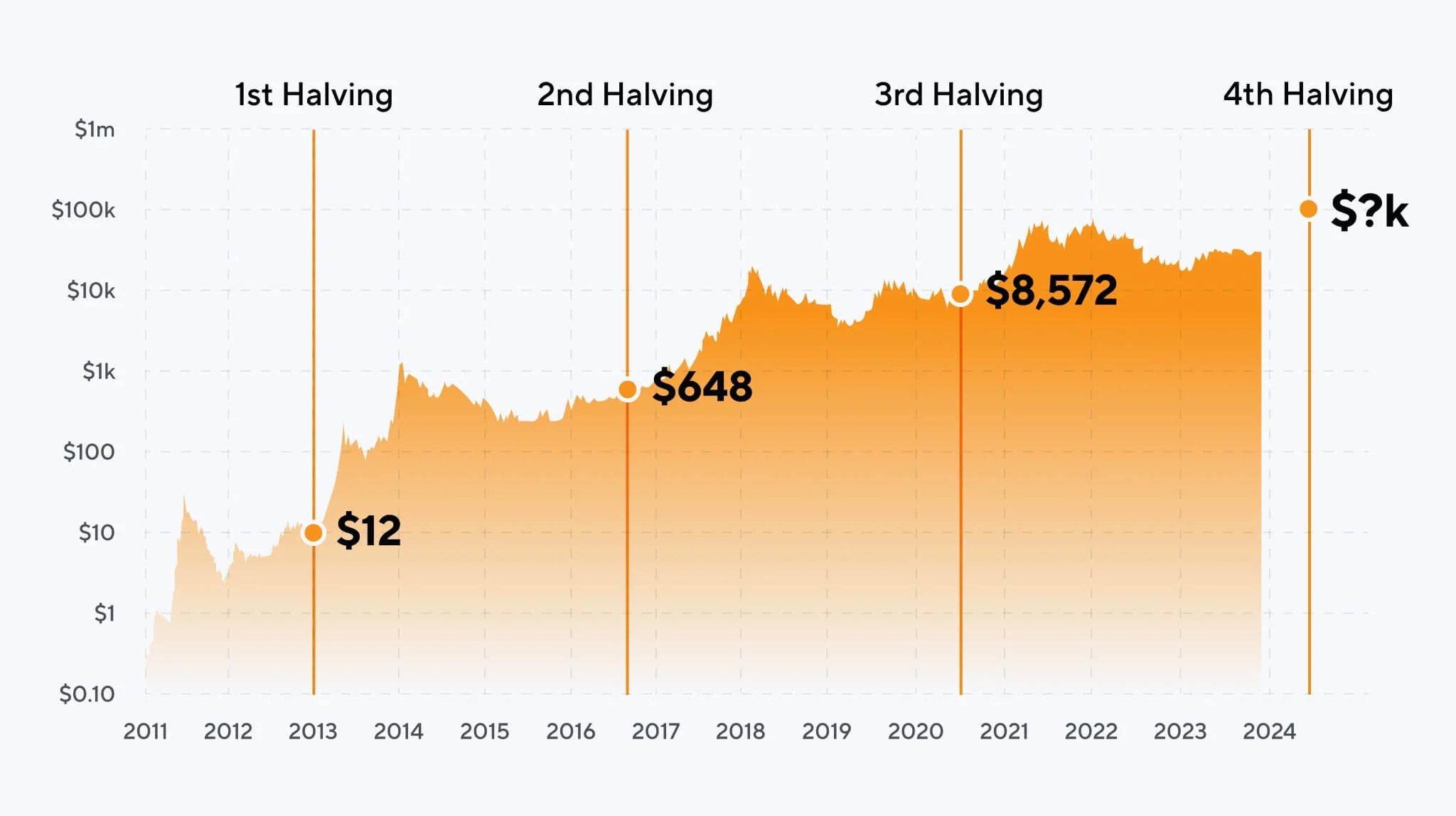

As we approach the next highly anticipated Bitcoin halving event in 2024, the cryptocurrency world is abuzz with anticipation. As the calendar turns to a new year, it’s the perfect time to dive deeper into what the Bitcoin halving entails, its historical impact, and what we might expect to see in the markets leading up to and following this pivotal moment for the world’s largest cryptocurrency.

Source : Nexo.com

Understanding the Bitcoin Halving

At the core of the Bitcoin network is a process known as the “halving” or “halvening.” This pre-programmed event occurs approximately every four years, where the reward for miners who validate and add new transactions to the Bitcoin blockchain is reduced by 50%.

This works because new Bitcoins are gradually introduced into circulation through the mining process. Miners are rewarded with newly created BTC for verifying and packaging transactions into blocks. However, the Bitcoin protocol was designed by Satoshi Nakamoto to have a finite supply of 21 million coins.

To help control the rate at which new BTC enter the market, the block reward given to miners is cut in half at regular intervals. This has happened three times previously:

- 2012: Block reward reduced from 50 BTC to 25 BTC

- 2016: Block reward reduced from 25 BTC to 12.5 BTC

- 2020: Block reward reduced from 12.5 BTC to the current 6.25 BTC

The 2024 Bitcoin Halving

The next scheduled Bitcoin halving is expected to occur on the 19th of 2024. At that time, the block reward will be reduced from 6.25 BTC to just 3.125 BTC.

This reduction in new BTC supply entering the market is widely anticipated to have significant implications for the cryptocurrency’s price and overall market dynamics. History has shown that Bitcoin price tends to rise substantially in the 12-24 months following a halving event.

ALSO READ : Is Shiba Inu Coin ever going to hit 50 Cents or a dollar?

Potential Impacts of the 2024 Halving

Miner Profitability and Network Hashrate

One of the key effects of the halving is that it reduces the profitability for Bitcoin miners. With the block reward cut in half, miners will see a 50% reduction in their revenue. This could lead to less efficient miners shutting down their operations, at least temporarily, as they struggle to maintain profitability.

However, the more efficient, high-powered miners are likely to remain operational, potentially leading to a short-term drop in the network’s overall hashrate as less profitable miners exit. This could create some volatility, but the remaining miners are expected to upgrade their equipment to more efficient models to compensate for the reduced rewards.

Stock Prices of Mining Companies

The public stock prices of major Bitcoin mining companies often decline in the lead-up to and immediately following a halving event. This is because the reduced revenue from mining puts pressure on their profitability, at least in the short term.

Publicly traded mining firms like Marathon Digital Holdings, Riot Blockchain, and Hut 8 Mining Corp. have experienced significant stock price swings around previous halving events. Investors will be closely watching how these companies navigate the 2024 halving and any impact it has on their financials.

Market Speculation and Price Movements

Historically, Bitcoin’s price has seen substantial increases in the 12-24 months following a halving. This is because the reduced supply of new BTC entering circulation is seen as a bullish signal by many investors and traders.

However, there is ongoing debate about whether the effects of the halving are already “priced in” to Bitcoin’s current valuation. Some analysts believe the market has already factored in the anticipated supply shock, while others expect the 2024 halving to still drive significant price appreciation.

Ultimately, Bitcoin’s future price movements remain highly speculative, and the halving is just one of many factors that could influence its trajectory. Volatility is likely to pick up as the event approaches and unfolds.

Long-Term Implications

From a bigger-picture perspective, the Bitcoin halving events are a critical part of the cryptocurrency’s monetary policy and inflation schedule. Each halving reduces the annual inflation rate of BTC, moving it closer to the eventual 21 million coin supply limit.

This controlled supply is intended to help maintain Bitcoin’s scarcity and store-of-value properties over the long-term. As new BTC enter the market at a slower pace, existing coins may become more valuable, potentially driving increased adoption and usage of the Bitcoin network.

Investment Considerations

For investors and crypto enthusiasts, the 2024 Bitcoin halving represents both opportunities and risks. On one hand, the historical price increases seen after previous halvings suggest it could be a profitable event.

However, the lead-up and aftermath are also likely to be marked by heightened volatility. Bitcoin is already known for its wild price swings, and halving-related speculation could exacerbate that.

As with any investment, it’s crucial to do your own research, understand the risks, and only invest what you can afford to lose. Diversification is also key, as Bitcoin should be just one component of a broader investment portfolio.

Conclusion

The 2024 Bitcoin halving is shaping up to be a pivotal moment for the world’s largest cryptocurrency. While the long-term impact remains to be seen, it’s clear this event has the potential to reshape the crypto markets in profound ways.

Whether you’re a seasoned Bitcoin investor or just starting to explore the digital asset space, staying informed and prepared for the halving will be crucial. As the countdown to April 2024 begins, the cryptocurrency community will no doubt be watching this milestone event with rapt attention.

Found this interesting? Share!

and then

and then