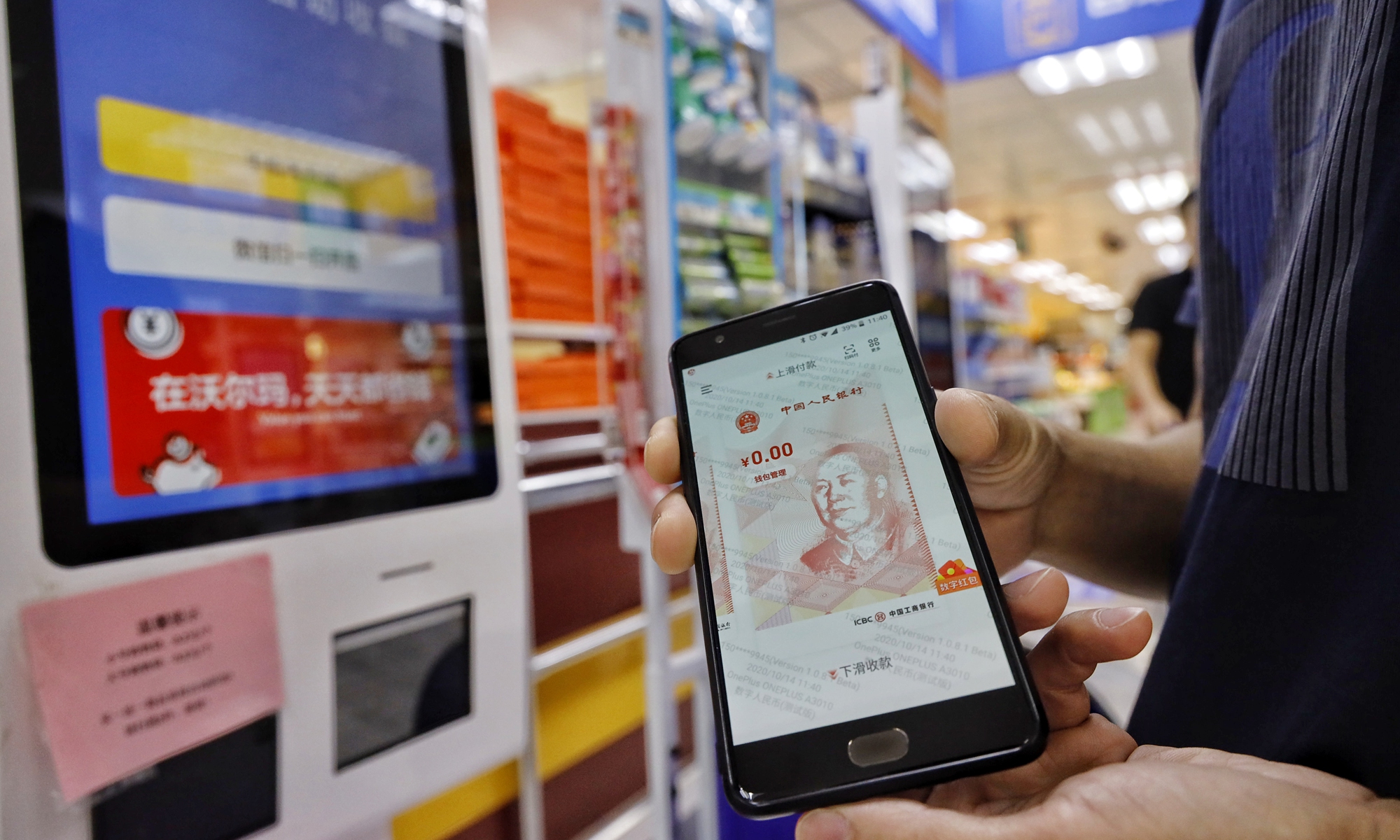

China recently disclosed plans to move solely to the “digital Yuan,” also known as the Digital Currency Electronics Payment (DCEP).

The Asian country has not released enough information about the currency yet as the test is still ongoing.

In October, China carried out the first public test for the first digital sovereign currency.

The Chiese government distributed the first batch of the digital currency (Yuan) valued at $1.47 million in Shenzhen through a lottery program.

Giving that the digital currency is still undergoing public trial, it was only available for 50,000 lucky winners.

Each of the randomly selected winners was handed a red envelope which contained RMB 200 each, approximately $30.40.

What is digital Yuan?

The digital Yuan is built to replace the physical cash (including banknotes and coins) in circulation.

Interestingly, the idea was initially birthed by the former People’s Bank of China (PBOC) Governor, Zhou Xiaochuan.

Xiaochuan had already envisioned a time where the dominance of cryptocurrencies such as Bitcoin will be inevitable.

However, he saw a future where China was not subjected to or forced into adopting alternative coins simply because it failed to build its own.

Source: Blockchain News

As such, the need to birth its own independent digital currency instead became mandatory.

Strongly-backed by the China Central Bank, the new “digital Yuan” is attempting to adopt a more sustainable cashless policy.

ALSO READ: Facebook’s Libra Currency Gets January 2021 Launch Date

More so, the new policy, according to industry experts, is an attempt by the Chinese government to establish its own “sovereign” digital currency.

Why is this very important for the Chinese government? If peradventure the initiative is successful, it may set a global standard for other countries.

Currently, there is no known standard to follow for the adoption of CBDC globally.

Hence, it is easier for the Chinese government to set a global standard for CBDC adoption upon a successful trial.

Also, this project’s success could translate to the massive adoption of financial technologies by other countries.

China is not the only country planning to adopt CBDC

In terms of global adoption, industry expert Igor Pejic revealed that China is not the only country attempting CBDC.

According to Pejic, at least “some 10% of Central Banks are already working on a concrete pilot.”

Some of these countries include Uruguay, Sweden, and the European Central Bank, among a few others.

Taking a closer look, Sweden has gone steps ahead in its endeavor as well.

The country had staged a pilot scheme called “E-Krona” hoping that it turned out to be a success.

Already, majority of the Swedish use a mobile application known as Swish.

However, the adoption of financial technology in Sweden indicates a growing predominance of cashless payment in the country.

How digital Yuan works

Similar to other digital currency, digital Yuan will operate like most other digital payment systems.

As expected, consumers and businesses that want to trade with the digital currency will be prompted to download a “wallet” on their devices.

More like a mobile application, the digital wallet will double as users’ personal bank.

As such, consumers can fill their wallets with money from their various commercial banks, which will no longer roll out cash.

Source: CGTN

Contrary to the general knowledge of digital currency, commercial banks will not be rendered useless. Instead, they will still serve as a reserve for bulk savings.

Also, this payment system’s availability will allow users to make trillions of dollars’ worth of cashless transactions annually.

Overall, the digital Yuan does not necessarily give its users financial freedom as other alternative coins like Bitcoin.

On that note, it is safe to say that there is nothing extraordinary about China’s “digital Yuan.”

As a matter of fact, most people who have tried out the payment system have criticised it for similar reasons.

How Citizens reacted to digital Yuan

China’s digital Yuan is considered the most advanced of the several Central Bank Digital Currency (CBDC) initiatives.

However, far from expectations, most of those that participated in the first trial were not exactly impressed by the initiative.

Firstly, the trial period only allowed them to use the currency for only a limited period of one week.

This, in itself, is a minimal time for many to experience the currency in its full capacity.

ALSO READ: Cryptocurrency: Etherum 2.0 Could Further Spike Another Bullish Market Sentiment

In addition to that, the digital Yuan played out on a contrary note as people didn’t necessarily get financial freedom as expected.

Source: Nikkei

Also, majority complained that the currency was a dubbed version of WeChat Pay and Alipay.

How that matters isn’t very clear; although giving our earlier explanation, the digital Yuan doesn’t offer anything extraordinary.

Really, why should the general populace abandon the likes of WeChat and Alipay?

A little digression

It is now clear as broad day why the Chinese government clamped down on the Ant Group recently.

For beginners, the Ant Group is the operator of the popular payment app – Alipay. The digital payment platform is one of the biggest in the country.

More so, initiative such as Alipay is a confirmation of the already-digitized nature of the financial transaction in China.

According to an industry source, mobile payment apps in China handled no fewer than $7.8 trillion in Q1 2020 alone.

In a recent development, Alipay attempted to list a record-breaking IPO valued at about $34.5 billion.

The successful listing of the IPO would mean more dominance for Alipay, giving it a stronghold on the Chinese economy.

However, due to an unfavorable government decision, the likelihood of listing the IPO is no longer visible, at least in the short term.

Now, it’s safe to assume that the disruption of Alipay’s IPO was politicized to favor the digital Yuan’s eventual adoption.

Chinese digital Yuan vs. other alternative coins (cryptocurrency)

You’d be making a big mistake by comparing the digital Yuan to the more controversial coins such as Bitcoin.

Bitcoin, Eherum, and their likes are mostly unregulated and high volatile to market sentiment as the case may be.

On the other hand, the Chinese Yuan is a stable coin that functions just like the regular banknotes. Only that in this case, the mode of transaction is cashless.

Additionally, digital Yuan differs from cryptocurrency in terms of control.

Source: Bitcoin News

As stated earlier, because the digital Yuan is not as decentralized neither anonymous as most alternative coins, it will be backed and regulated by the People’s Bank of China.

On that note, people can’t enjoy the luxury of financial freedom that comes with unregulated digital currencies.

Unlike the alternative cryptocurrency, the digital Yuan is designed to be “traceable, ostensibly to track and neutralize corruption and other financial crimes.”

According to an industry source, the ability to track all transactions made with DCEP will give China regulatory authority.

“A degree of control over their economy that most central banks do not have, especially when dealing in physical cash,” the source added.

ALSO READ: CBN’s 1% Charge On Failed Direct Debit Transactions: What It Means For Bank Users

Lastly, the ability to track transactions gives the Chinese government or policymakers greater visibility into how money flows around the Chinese economy.

Quoting an industry source: “This new digital financial practice, especially during extreme economic circumstances, would allow the government to have negative interest rates for cash.”

Is CBDC an adoptable initiative in Nigeria? What Techuncode thinks

Quite frankly, no country cannot adopt the CBDC initiative. At least after taking out the cost of implication, as well as other advanced technical facilities required.

However, realistically, there is more to the adoption of a digital currency than affordability.

In Nigeria’s case, many challenges may pose as a hindrance to the full adoption of CBDC.

Below are major challenges Nigeria may have to resolve to adopt the CBDC initiative fully:

Literacy rate

To begin with the grassroots challenges, the literacy rate in Nigeria is still less than 65%.

This implies that a good percentage of over 35% will find the adoption of CBDC very challenging.

Mind you; the 65% literacy rate does not necessarily mean that the majority are digitally-inclined.

On the contrary, a country like China boasts of approximately 96.84% literacy rate as of 2018.

Realistically, adopting a CBDC initiative is more visible in a country with a high literacy rate.

Internet penetration

Another major constraint in Nigeria’s adoption of CBDC may also be in terms of internet penetration rate.

Recently, NCC reported that internet users in Nigeria had surpassed the 149.8 million mark.

This figure puts the percentage of internet penetration in the country to about 74.9%, which is relatively a good number for a developing nation.

However, this may not be the same when it comes to the full adoption of CBDC.

The reason is that the remaining 25% poses a significant challenge for the full adoption of the digital payment system.

In comparison, China recorded approximately 54.3% in internet penetration as of 2017.

Indeed, this is a lower rate than that of Nigeria; however, vis-à-vis total population, it is considered a high figure.

This, however, can play to the advantage of the Nigerian government, even better than the Chinese government.

Considering that the implementation of the CBDC policy is a gradual one, the replacement of banknotes with digital alternatives is instead a progressive one.

Technological advancement

Finally, Nigeria is still laidback in technological advancement, especially when put on a scale alongside a country like China.

Source: PYMNTS

However, this is not to say Nigeria is very poor in this aspect; somewhat, the country still lacks notable advancements.

Building or developing a highly technical project like blockchain technology or digital payment requires more than expertise.

ALSO READ: FG To Trade Three Power Plants For N434 Billion: What It Means For Nigeria

Interestingly, Nigeria boasts of millions of ICT intellectuals. However, that’s not sufficient for the execution of this kind of delicate project.

Facilities such as uninterrupted electricity supply, a secure channel of distribution, accountability and transparency in operation are other requirements.

What do you think of China’s digital Yuan? Do you see Nigeria replicating such an initiative in the just-commenced decade?

Kindly share your thought with us in the comment section below.

and then

and then