This year has been a very eventful one so far, thanks to the ongoing COVID-19 pandemic and, of course, the persisting recession that hit the Nigerian economy.

The impact of these challenges on Nigerians has rather been a deteriorating one giving that majority have been pushed beyond limits.

Although Nigerians are known for their resilience spirit, this year has mostly affected many people’s wellbeing, mentally or financially.

As such, the recovery process is a gradual one and is expected to run into weeks, or perhaps months, as the case may be.

Spending-wise, many Nigerians are trying hard to recuperate from financial losses attributed to the ravaging impact of the pandemic.

Subsequently, this has greatly impacted the spending habit of average Nigerians, with many prioritizing their spending expenses in order of importance.

2020 holiday shopping predictions

Unlike the previous years, holiday shopping for 2020 may record a downward trend, to say the least of expectation.

However, giving that online shopping in Nigeria often records high numbers during November and December period, a downward shopping trend might not necessarily be the case.

ALSO READ: Singles’ Day: Alibaba Doubles Nigeria’s Budget In 11.11 Sales

While you may hold doubts about this, a recently-released report by Techuncode also backs the claim.

Themed Holiday Shopping Behaviour (PDF), the report suggests that despite the economic condition of Nigeria and the COVID-19 impact, most Nigerians (68%) still have plans to shop for this year’s end-of-the-year festive season.

More so, in a survey carried out to determine how and when people plan to shop; a combined 83% of respondents suggest to do so a few weeks before and into December.

This article will analyze how Nigeria’s shopping activities are perceived with more focus on online shopping.

Shopping activities in Nigeria

Over the last couple of years, there has been an upward trend in the paradigm shift from offline shopping to online shopping.

As seen in the graphic illustration below, the YoY growth of online shoppers increased by a marginal 1.3% between 2018 and 2019.

This boost accounted for an additional 5.3 million online shoppers in 2019, as against the figure recorded in the previous year.

Taking a closer look at the traits exhibited by online shoppers, we also discovered that majority of the online shoppers (56%) are within the demographic age of 25 – 54 years.

Next in line are the much younger generation between the age range of 18 – 24 years.

They account for about 17% of the demographic age distribution, same as those whose age range falls between 35 – 44 years.

On the downside, the older shoppers between the ages of 45 – 54, 55 – 64, and 65+ account for 6%, 2%, and 2% of the demographic age distribution, respectively.

Additionally, a 2018 Geopoll connected to Nigeria e-commerce consumer and shopping behaviour indicates that more men (about 63%) shop online than women (pegged at 37%).

Why and what exactly do Nigerians buy online?

With more shopping activities taking place online, the question of what do people really buy pops up.

However, it is important to note that what people buy is a function of why they want to buy a product online.

ALSO READ: Google’s Service Outage Reveals World’s High-Dependency On The Tech Giant

For instance, based on Techuncode’s report, we discovered that many buy products mostly because of their functionality. Really, why else should one buy a product if not for the function?

Well, that’s not the case every time; other factors such as price, features, packaging, and availability, among other indexes, determine why people buy a product.

Having stated that, what exactly do Nigerians buy the most online?

As expected, electronics had the majority of shoppers’ top choice of online purchase, accounting for a whopping 41%.

It is immediately followed by household appliances which account for slightly above 50% of the former with only about 23%. Interestingly, this category of products is still related to electronics.

On the other hand, clothes and beauty/skin products account for 17%, respectively, with other products accounting for a meagre 2% of the online purchase distribution.

While the high numbers recorded in electronics can be attributed to the high number of male gender demography; the low number of clothes and beauty/skin products can be attributed to the lower female gender demography.

Male mostly shop for gadgets only, whereas females, on the other hand, major in household appliances, clothes, as well as Beauty/Skin products.

Shopping during festive/end-off-the-year season

There is usually a big gap in the sales activity during random shopping and that which takes place during festive seasons such as December and January.

In Nigeria, the period between Christmas and New Year is mostly dedicated to rush hour sales, holidays and vacation either from the academics or corporate sectors.

As a result of this, there is a boost in online shopping, which takes a toll during the festive season compared to every other time in the year.

More so, the November period, which accounts for virtually the highest online shopping activities in a year, a feat that is attributed to the Black Friday sales, comes ahead of December.

As such, shoppers’ excitement about purchasing products online extends further into December, which naturally comes with its excitement.

While the festive season accounts for a shooting online shopping activity, what product do people mostly shop for?

As seen in the above graphic illustration, approximately 35% of shoppers purchase gift baskets; 30% do monetary gifts; 26% clothes; 22% of shoppers do Christmas cards, sweets, and footwear, respectively, while only 17% do toys.

While the above figures were extracted from a 2018 data, some of these activities may vary in recent times.

Which period do people actively do the festive season shopping?

Furthermore, we looked into when people do their festive season shopping (drawing an instance from a 2018 data).

While many Nigerians, about 57%, do their season shopping in December, others shop ahead of then.

November also accounts for a high figure, with about 26% of Nigerians shopping for the festive season.

ALSO READ: Carbon Emissions Are Still On The High Side Despite COVID-19

On the other hand, October and September account for about 8% and 9% of people shopping during the festive season.

Generally, most of the festive season shopping occurs during the third of the year; with approximately 92% of online shopping activities taking place during this period.

Spending and decision drivers for end-of-the-year shopping

Here, an online survey carried out by Teksight Edge, a PR firm, indicates that an average Nigerian intends to spend between N10,000 and N100,000 for End-of-Year Shopping.

However, contrary to the previous year, where people shopped mostly based on the price of product and features, most respondents will be shopping based on their needs and dependency this year.

As seen in the graphic illustration above, key indexes influencing shoppers this season also include the price of products, euphoria of the season, product availability, and sales promotion.

Impact of COVID-19 on consumers’ Christmas spending in Nigeria

As stated earlier, the impact of COVID-19 on consumer mostly have to do with a lack of sufficient funding.

With the obvious stated, coupled with an online survey response, consumers’ Christmas spending in Nigeria may dip this year.

When asked if the COVID-19 pandemic would affect spending during this year’s festive season, majority (55%) of the respondents answered “yes.”

However, about 27% of the respondents are not so sure if COVID-19 will impact their spending.

On the other hand, a relatively high 18% of respondents are confident that the pandemic won’t affect their spending this festive season.

Nigeria recession and its impact on consumers’ end-of-year spending in Nigeria

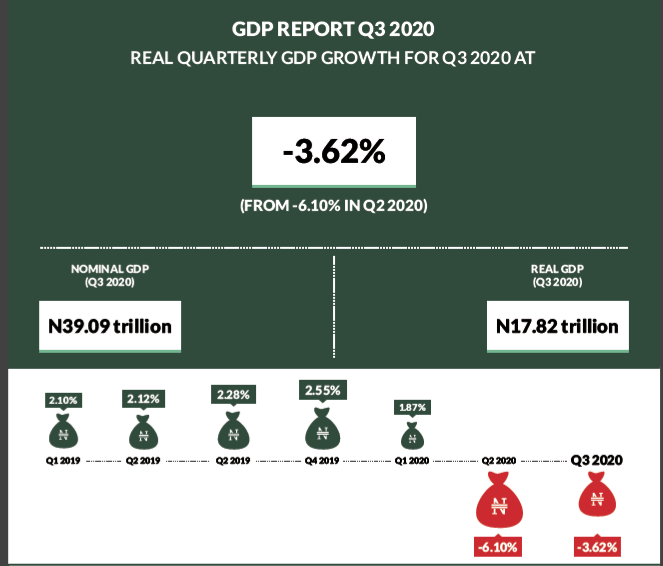

A recent report by the National Bureau of Statistic (NBS) revealed in its report (PDF) that Nigeria’s QoQ Real GDP contracted for the second time in a row.

As spotted in the report, the Q3 Real GDP contracted by a negative -3.62%, following a similar trend from Q2, which also recorded a negative -6.10%.

Source: Nigeria Bureau of Statistics

While all indications point to a similar trend for the current quarter (Q4); the nation’s economic status may impact consumers’ end-of-the-year spending.

When asked if the current Nigeria economic status would impact spending during the festive season, more respondents (67%) answered that the recession would significantly affect their buying power.

ALSO READ: NCC Takes New Decision On SIM Card Registration

This time around, fewer respondents (18%) fell in between as they are not so sure if they will be affected.

Similarly, fewer respondents (15%) also think they are exempted from the negative impact of the recession.

2020 holiday shopping forecast

Considering the previous and current market trends, this article will highlight major forecast for this year’s festive season shopping.

First, majority of the online shoppers will do their shopping locally during the festive season

In an online survey, we discovered that about 74% of Nigerian shoppers want to buy their products from local vendors.

About 9% of the respondents want to buy from Asia; 7% from Western Europe and North America respectively; 2% from the Middle East, while only 1% targets other African countries.

Secondly, more shoppers will make use of cash payment methods while shopping during this festive season

In another online survey, about 31% of respondents still make cash payment; this could also imply that a large portion of shoppers still actively engage in offline

On the other hand, 24% of respondents make use of credit card payment; 18% bank transfer; 15% mobile payment; 10% cash on delivery; and 1% for gift cards and e-wallet respectively.

Thirdly, majority of the shoppers will shop online via the use of smartphones

Although this is the exact situation in the previous year; an online survey carried out for this year also backs the claim.

According to the survey result, 47% of the total respondent intends to do their shopping via smartphone; 29% via laptop or PC, while the others (24%) do not have any preference.

Lastly, majority of the online shoppers will only shop for perishable items like foods and drinks

Based on an online survey, 38% of respondent wants to shop for food and drinks; 23% clothing; 14% household appliance; 11% beauty/health; 7% travels; 4% consumer electronics; 2% furniture; and 1% for toys, and artworks respectively.

What Techuncode thinks

It is quite easy to predict a negative trend for holiday spending in a post-COVID era; especially in a recession-hit nation like Nigeria.

However, the excitement that comes with the festive or end-of-the-year season is overwhelming and can drive an unusual positive market trend.

Click here to download the FULL REPORT on Trends Surrounding Shopping Behaviour during the Festive Season in Nigeria.

and then

and then